I get that anything is worth whatever someone is willing to pay for it. That’s besides the point. My point is, beyond speculation, what do crypto coins represent?

I also understand that the value of the US dollar is being questioned almost as much without the backing of gold.

But what I really want to know is what is at the foundation level of Bitcoin that people are buying into?

I have a basic understanding of the blockchain, etc. I sold 1BTC in 2017 for $1200 when I thought that was as high as it would go. At this point, at over $100kUSD and rising steadily, what is the $ limit and what is that limit based upon? I thought it was based on the value of mining to check transactions but this seems… not worth $100k to me.

I’ve been thinking, the only tangible value I personally see in Bitcoin, because it’s not really being used as legitimate currency, is for criminals. By now, there must be trillions of dollars in BTC acquired by criminals holding corporations hostage. When you’ve got people like Trump involved (either explicitly or by way of manipulation) with an executive order to establish a crypto czar, this suggests to me that he’s creating pathways for bad actors to more effectively gain more wealth. These are the people who are most excited in Bitcoin, beyond speculation.

I mean, there’s little to nothing on the up and up with crypto, right? It’s a scam. Right?

Please, factual answers only. I’m looking for someone to dispel my speculation with genuine economics of the matter.

So you know how fiat currency is backed by nothing more than the fact the government says it’s valuable and we all agree to that? Crypto is sort of like that except without the government bit

Fiat currency is backed by taxation, which can only be paid in the very same currency that the taxer prints.

📺 Your Taxes Pay for NothingSome states have been looking into allowing you to pay your taxes with crypto, so checkmate atheists.

No stable state with a strong currency would ever do that.

Based on … What exactly? Your gut feelings?

Yup, all boils down to faith in the currency. For something like the dollar, it’s backed by faith in the US government. For something like Bitcoin, it’s backed by faith in the resilience of the blockchain and the value buyers place on it. Emperor Norton minted his own currency which was accepted all around San Francisco based purely on the fact that people accepted it.

It’s a lot more backed by the faith that if you don’t manage to get some you go to jail.

But I can buy anything with fiat curency and with bitcoin I can basically buy nothing. And I never will be able probably, bitcoin is too slow to be used as an actual curency to buy common things like groceries

bitcoin is a bad currency but you absolutely can buy legal things. like, check shopinbit. there’s also a similar website that buys the thing for you from amazon

Bitcoin is pretty fast. You get 5 confirmations in about an hour. If you compare it to credit cards, the equivalent thing (clearing and settlement) happens in about 2-7 days.

Thing that matters to the merchant is a bit different than the thing that happens with the customer. You can build similar layers in front of the customer for crypto payments that make it look like the payment went through in a second.

Payments of this nature using the layer 1 blockchain are not super feasible, as you say. (Although I’ve made several online purchases using BTC and it works quite well.) However, layer 2 solutions like the Lightning network do allow for extremely fast and cheap transactions, then they use the slower layer 1 blockchain for final settlement later.

Cryptocurrencies have three main attributes that affect their usability: Speed, Security and Costs. You can pick any 2 but there’s always a tradeoff with the 3rd. For example, BTC chooses to prioritize security over everything else. This results in it being slower and sometimes more expensive than other crypto, but that extreme security is what makes it such a good store of value over the long term.

If you want faster and cheaper transactions, you can use other cryptos like Solana but the security and reliability is no comparison.

You’re right, you may never use layer 1 for everyday transactions but there is nothing better when it comes to storing and transferring large amounts of value. So just sell a little BTC every now and then and convert it into whatever currency you need for everyday use, whether that be fiat or some faster, cheaper (but less secure) cryptocurrency.

People buy big ticket items like cars and houses with bitcoin, not chocolate bars.

Except the lack of government AND the massive amount of pollution and resources waste.

My point is, beyond speculation, what do crypto coins represent?

Nothing.

One could argue envriomental damage or power consumption, which is of almost no relevance to a currency, but thats the imprint they leave on the world because of their existence.

Yeah, this is what I came here to mention. Environmental damage and power consumption are what bitcoins cost, but those costs don’t give bitcoins any inherent value.

It’s actually a pretty appalling example of human ingenuity. We’ve managed to invent something that has a disproportionately terrible impact on every person on earth through its environmental effects, while simultaneously producing no practical value to anyone other than those wealthy enough to be in control of it.

but those costs don’t give bitcoins any inherent value.

Because bitcoins cost X to produce, people believe they are worth X.

At its core, it represents an irreversible proof of digital existance. Blockchain is the only technology that can do this, and it makes it more valuable than you’d think.

Bitcoin itself has first mover advantage, and that keeps it on top. It’s hard to point to any particular feature of bitcoin that warrants this first place position, aside from pure decentralization of holdings.

The irreversibility of blockchain transactions is very underrated to most of us, but think about it… no bank or government, even with military involvement, can reverse a transaction or seize assets. For most of us in nations with sophisticated financial infrastructure and govt, this doesn’t sound like a big deal, but for the majority of the world, this is a huge deal.

It also represents freedom from fiat. Since the beginning of currency govts have used it as a means to extract wealth from the populace. Printing, confiscating, and controlling as it pleases them. We’ve historically used gold to hedge against this, and there’s even instances in history where govts have devalued and confiscated gold as a means of supporting itself. Bitcoin brings all the freedom of gold, with all the benefits of the digital world.

Awesome. I appreciate this perspective.

Can you dig a bit deeper into the benefits for normal people that an irreversible transaction offers? To me, this seems like a detriment. Like, if I sell something on eBay and it turns out to be broken or fraudulent, PayPal can reverse the charges for me. Actually, I have a real world example of buying sneakers online that never arrived and had my credit card reverse the charges for me.

It’s not a benefit in the example that you provide. It’s a benefit to the seller for sure. For that type of transaction it benefits you with lower prices due to retailers not having fraudulent sales result in chargebacks. This is the reason you’ll see it adopted by merchants (not Bitcoin, but stablecoins on Solana or Eth L2s).

The benefits on the consumer side are around freedom of money - no seizures, no bank runs, no fraudulent cc charges (but added key management risk), no inflation (eh, but added volatility rn), instantaneous worldwide transfers (that’s where you see the remittance market buying in). Also new decentralized financial markets which bring better yield rates than banks.

It’s a little more gray on the consumer side and I would expect services built on top to add insurance, escrow, and custody (exchanges and banks) type features.

The other place it’s making waves is with larger amounts of money. Hedge funds, venture capital, and higher net worth individuals. It makes moving capital around much easier.

So in that realm we see growth with it making its way into traditional markets - like stocks and commodities. Instantaneous settlement in this world is huge. Stock transactions can take anywhere from a day to 3 days in the tradfi system. On-chain we make atomic, irreversible, censorship resistant transactions instantly.

You can already see companies launching stock backed tokens on chains now. Just a couple weeks ago StockX went live on Solana. Anyone can buy US stocks, anonymously, with no onboarding requirements. This disrupts global capital markets.

So in summary, the benefits down at the consumer level focus more around access to new, secure products for earning yield and availability of alternative inflation-free assets with instant availability.

Also, privacy. This world really re-enables us as consumers to have some financial privacy. That’s another whole rabbit hole tho and my thumbs are tired.

I guess it’s more useful as a store of wealth than a currency. Like gold it can be transferred irreversibly between owners, except now the transfer and storage costs are significantly reduced and it’s available to the general public as an option. The key benefit is the use of the internet as a transfer medium, you no longer have to rely on a third party to facilitate the exchange, which for most large transactions means paying someone to transport it and store it (lawyers, guards, banks).

It does allow for easy exchange for all users, including criminals, but generally using it for crime is a terrible idea, as every member of the network can see all transactions. Bitcoin is more of a notice board about what addresses have what amounts, and if you can prove to the people that post on the notice board that you control an address, you’re allowed to spend the contents and update everyone of where you sent it.

People came up with an idea for how to do chargebacks, it’s called an escrow service, a third party that holds the money until all parties have had a chance to raise a dispute and confirm they are happy. This is the same as how PayPal works, trust based on reputation of the escrow provider, and the escrow provider is payed a fee. It’s just that now with bitcoin, you also have the option to complete the transaction online without an escrow provider, the same as you would in person with cash.

So PayPal or your bank are third parties that you have to trust will act honourably.

You can still do that with cryptocurrency and use third parties or dapps with escrow style protection features but you can also do direct transfers, without any third party involvement and no protection, like giving cash to someone requires no third party approval and there are no protections.

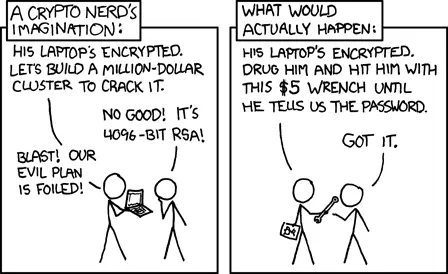

Almost relevant XKCD

There’s many defenses around a $5 wrench attack. But in the end, no, crypto doesn’t fix crime.

Removed by mod

This is actually quite good. OC? / Source?

Removed by mod

I always pay my respects to a fellow knower

o7

To you and yours

i’m glad you said that, i was confused if this was either an apocryphal from ayn rand… or the great nagus, who knows.

Removed by mod

I was unironically checking if someone had posted this or else I would.

Thank you.

Beanie babies 2.0.

the only tangible value I personally see in Bitcoin, because it’s not really being used as legitimate currency, is for criminals.

Please, factual answers only.

In 2021, 0.15% of known cryptocurrency transactions conducted were involved in illicit activities like cybercrime, money laundering and terrorism financing

sounds like the word “known” is doing some heavy lifting there

The assumption that bitcoin is only used by criminals is much less accurate.

You’re gonna have to give me a source for that buddy.

It came from here but this source has more detail.

Is that by total number of transactions or by bitcoin volume?

I copied that from Wikipedia which got their reference from through NY times.

For specific details, this is probably a better source https://www.trmlabs.com/resources/reports/the-illicit-crypto-ecosystem-report-2022

This is not the same for all crypto currency, but a bitcoin represents a “proof of work”. When people “mine” bitcoins, they are consuming computational resources, and when they find a bitcoin, it is a certification of the work that was done to find it that becomes the value of the coin. And then, as others as mentioned, people just agree that that work has a certain amount of monetary value. But the proof of work is what limits the supply and allows that value to exist. 3Blue1Brown has a really good video that goes into the technical details if you’re interested.

Thank you for being one of the few to take me seriously and offer a thoughtful response.

I can understand now the value of a token that represent some amount of effort that is limited in its supply. As “promised”, no other bitcoins will ever be made. So this alone makes it worth something. The fact that it represents some amount of effort achieved does seem to give it some validity. Although, IMO, certainly not $100k worth.

I’ll need to think this over some more and maybe update this post with some more thoughts on the future of the coin.

The key feature is that there’s a mechanism that limits supply. Other than that, value only exists because enough people agree that it has value. Fiat currency is exactly the same in this regard.

I think your questions indicate that you don’t have sufficient understanding of how “ordinary” money works. It’s just a promise of being able to exchange it for goods & services in the future, and its value hinges on people trusting that promise.

(posted this comment somewhere else too)

(Paper) money is practically actually valuable because you need it to pay taxes. Gold, diamonds etc you could do without. Of course there is more nuance but taxes force people to value currency and therefore also accept it from others (because you need some of it or you go to jail), which gives currency the circular value.

What is a first edition holographic charizard worth? What is the utility of that card?

Things are worth what people are willing to pay for them.

You can’t eat a Bitcoin for sustainance. Or hammer a nail with it. You can’t do either of those things with a pokemon card either.

I feel like you get this, based on your post… But you still are hung up by it.

Bitcoin’s attractive utility for many is that you can transfer them pretty much unimpeded by any external entity. Like a government for example.

Like, hypothetically, what if you wanted to send a million dollars to your family back in, I dunno, Hong Kong. Do you think you can put that in a suitcase and hop on a plane? Do you think your bank will just send that wire? No. Government needs to know about it.

You can send a million dollars worth of Bitcoin, though. No problem.

What about if the government decides to seize your assets, for whatever reason? Maybe you were a little too loud about your support of Palestine and a man child president decided to make an example of you? They can raid your home. They can seize your bank accounts. Can they get your Bitcoin? Nope (if you’re actually holding it yourself)

What sets Bitcoin apart from other currencies is that it’s very government resistant. You CAN hold it yourself. Not digitally in a bank. Not as bills under your mattress. It cant be seized.

How much SHOULD Bitcoin be worth, given the utility it provides? No idea. But it’s something.

Bitcoin specifically? No. It’s a janky prototype that should have been superseded a long time ago.

Crypto in general? Probably something. It’s good for buying and selling illegal things.

Modern blockchain protocols dominate bitcoin in every dimension except market cap.

When it was first released, I was interested in the decentralized nature of it as a currency. I liked - well, I still like - the idea of a currency that isn’t controlled by a government. At the time (2009-ish?), I also thought it was anonymous, which also appealed to me; cash is mostly anonymous, but it can’t be used online, and even then the fact that society was increasingly moving toward cashless - and very traceable, and usary-heavy - credit cards was clear. Stripping privacy is critical to control.

Bitcoin isn’t anonymous, but other cryptocurrencies are, and bitcoin laid the groundwork. To your question, I, and many other people, paid some money to get some bitcoin - I think I spent $120? Mainly so I had enough to explore the space and play with it, because even then mining seemed painfully slow. Once money was spent on it, by whomever and for whatever reason, it acquired value: the value that, if you had some, you could sell it to someone else, or trade it for goods. In that way, it has the same value as an IOU on which I’ve scribbled “Good for $10 from Ruairidh Featherstonehaugh” and signed my name. Flawed metaphor, but you get there idea - the paper itself has no intrinsic value.

Despite that mining is so horrible for the environment, the concept that motivated Bitcoin still IMHO has value. An entirely digital, cashless system, not controlled by any one organization but rather by the community of participants. If Bitcoin didn’t have the environmental cost - if it has been proof-of-stake rather than proof-of-work, or if the computational work was actually something useful to society like gridcoin.us, it wouldn’t be so controversial. Sure, people are still going to be bitter about not buying into it early, but as long as people are willing to trade goods and services for it, it’ll have real value based on market rates.

This is an eloquent way to sum up how I feel about it! Good show 👏

not even fiat (heh) is worth anything if we don’t accept it as store of value, let alone an electronic register on a digital ledger.

Bitcoin has massive value as a tool to transfer money, anonymously, and through borders effortlessly. Its extremely valuable for money laundering, scamming, stealing, and dodging tariffs or raising money (see how much crypto is stolen by north Korea)

Bitcoin is a ponzi scheme with a really long time horizon. In a way, any fiat currency kinda is as well. The difference is that a government backed fiat currency like the US Dollar is backed by the US Government saying “you will accept the USD, or else”. That backing keeps the game running. Bitcoin has nothing like that. The only reason it keeps going is because of speculation, money laundering and the purchase of black market goods.

So, as long as you can go buy drugs or move money across borders with Bitcoin, it will have value. As long as it has value, some folks will speculate on it. That can keep prices up, right up until it doesn’t. So, as is always the case for speculative assets, caveat emptor.

The real answer is: It depends how you define value.

Can you make money with Bitcoin? Yes. Are you likely to make money? No Is the technology useful applicable? Yes Is it being used and applied ethically and for the good of people? No. Is it a ‘store of value’? No, it’s more like an extremely volatile stock or a lottery ticket. Can you use it like money? Yes Is there any reason to use it like money? Not really, not even among other cryptocurrencies.

Depending on which of these aspects of Bitcoin matter to you it will be more or valuable.

Just like anything else, it’s worth what people are willing to pay for it vs what people are willing to buy it for.

Currently bitcoin is just a digital commodity with a finite supply which makes it a good store of value if people continue to use it.

The thing is, there’s nothing preventing bitcoin from tanking and becoming essentially worthless besides people buying it because the price is low.

If in a hypothetical future the bitcoin price becomes stable then it will become a valuable commodity. It’s value is wholly derived from it’s users and nothing else.

It’s not very convinent for governments or large institutions to hold it in it’s current form since it’s too easy to steal without leaving a trace. For government use there is going to be needed some development to allow for government or Central banks to have complete control over the currency without giving that control away which I think might be possible. In that case settling international transactions in bitcoin as opposed to the dollar for BRICS countries might be an option which doesn’t use the US dollar.

All the other uses IMO are pretty much fluff such as paying in bitcoin.